In contrast, a company with a low equity ratio can end up exacerbating their situation during periods of financial turmoil due to their significant debt obligations. They are likely to face stricter scrutiny from lenders, possibly seeing their credit lines reduced or even canceled in extreme cases. This may eventually result in these companies needing to liquidate assets, lay off employees or significantly scale back operations. Hopefully, you now understand both what the equity ratio is as well as it’s importance. It’s a simple formula that can give you a nice bird’s eye view of the financial state of your company, and something you can easily calculate as you contemplate both investments and debt.

Shareholder Equity Ratio: Definition and Formula for Calculation

All of a company’s assets are the result of shareholder equity, loans from creditors, or a combination of both. Also, a higher ratio indicates that the company incurs less debt service costs since equity shareholders finance a higher portion of the assets. The return on equity ratio (ROE ratio) is calculated by expressing net profit attributable to ordinary shareholders as a percentage of the company’s equity. Like the debt-to-equity ratio, the equity ratio is important because it indicates your level of solvency. Solvency indicates whether a business can meet its debts and other financial obligations over the long-term. The elements of the equity ratio can be found on your company’s balance sheet.

Access Exclusive Templates

Financial Risk ManagementImplementing sound financial risk management practices can prevent undue liabilities from surfacing. This might involve diversifying your business activities, ensuring comprehensive insurance coverage, or perhaps hedging against financial risks. Operational EfficiencyImproving operational efficiency can help reduce operational liabilities, thus enhancing the equity ratio. This may encompass various initiatives including cost-cutting measures, improved inventory management, asset utilization, or process optimization.

- This is because a higher debt level puts the company under pressure to meet its debt obligations, possibly straining the company’s resources.

- It shows the proportion of equity that is used to finance a company’s assets in relation to borrowed funds.

- This means that if Company K were to sell all of its assets to pay off its liabilities, investors would retain ownership of ¾ of the company’s resources.

- In this guide, we’ll go through the equity ratio definition, what the equity ratio means for your business, and also review a few equity ratio examples.

- The reasons and importance of having a reasonable equity ratio for a company is explained as follows.

Company

The equity ratio is a leverage ratio that measures the portion of company resources that are funded by contributions of its equity participants and its earnings. The shareholder equity ratio is most meaningful in comparison with the company’s peers or competitors in the same sector. Each industry has its own standard or normal level of shareholders’ equity to assets.

It also indicates how profitable it would have been if all funds invested were shared by the investors and it shows how well a company is efficiently using its assets. This may tell the story of your company’s future, whichever way the dice may fall. Although this is an important ratio for investors or business lenders, it’s also important that you know operations management basics your equity ratio—and understand what it means relative to your business. For instance, you may look at your balance sheet, but are you comfortable with the story it tells with how leveraged you are? The shareholders equity ratio, or “equity ratio”, is a method to ensure the amount of leverage used to fund the operations of a company is reasonable.

Optimal Capital StructureIdentifying the optimal capital structure, which is the mix of debt and equity that minimizes the cost of capital, can greatly improve the equity ratio. Hiring financial consultants or investment banking services can be beneficial to guide these decisions. Companies with high equity ratios typically have a solid foundation of assets relative to liabilities. Such companies are more vulnerable to shifts in market dynamics, including changes in interest rates or downturns in earnings. So it is worth considering to use this ratio with other debt ratios, such as the quick ratio, current ratio or debt to equity ratio when performing your financial ratio analysis.

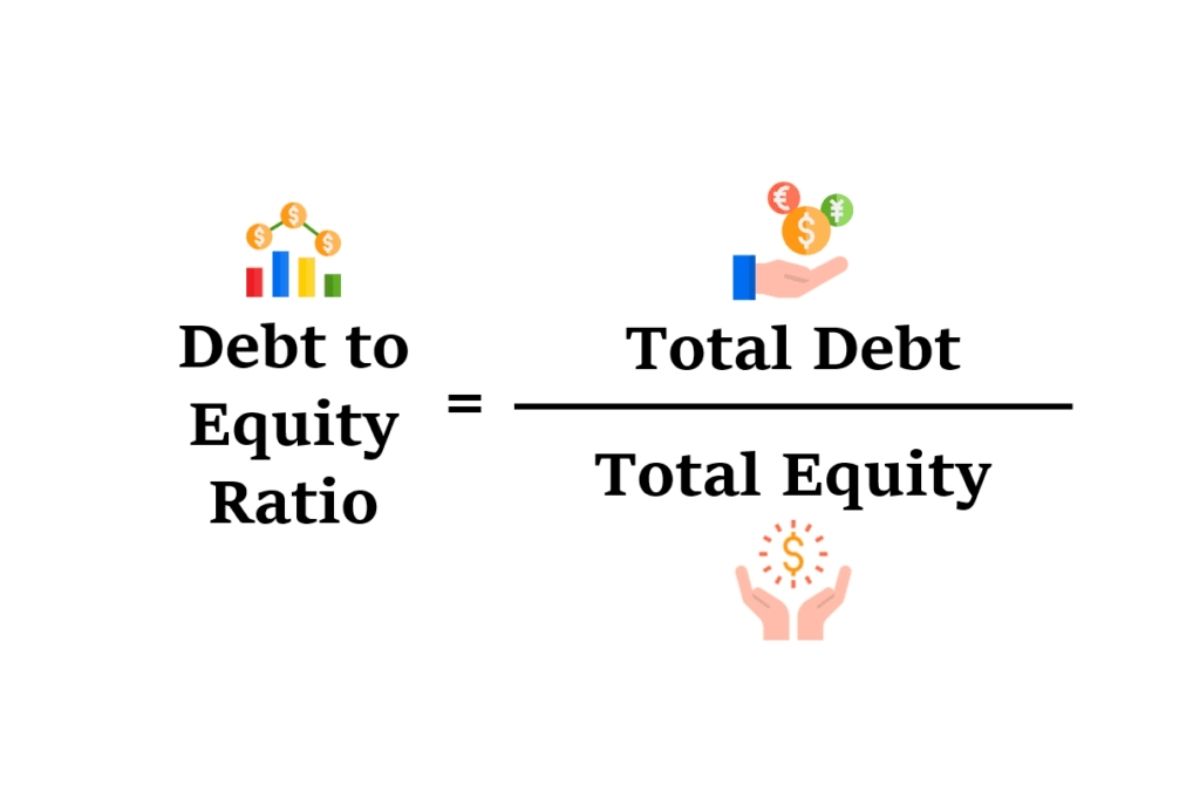

The equity or proprietary ratio is calculated by dividing the shareholders’ funds by the total assets. A conservative company has a stronger solvency position, and it will be able to pay off its debts on time. The ratio can be expressed as a percentage or number to show the proportion of a business that is financed by the owner’s equity compared to borrowed money. It is the total of share capital and retained earnings/reserved profits, less treasury stock. This ratio is considered a healthy ratio as the company has much more investor funding than debt funding. Shareholders’ equity includes Equity share capital, retained earnings, treasury stock, etc., and Total assets are the sum of all the non-current and current assets of the company.

As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy. However, it’s worth noting that these indicators should not be viewed in isolation. They form part of a broader suite of financial measures that investors must consider in making an informed investment decision. Total Assets are essentially everything a company owns that has monetary value.

The equity ratio is an investment leverage or solvency ratio that measures the amount of assets that are financed by owners’ investments by comparing the total equity in the company to the total assets. If a company sold all of its assets for cash and paid off all of its liabilities, any remaining cash equals the firm’s equity. A company’s shareholders’ equity is the sum of its common stock value, additional paid-in capital, and retained earnings. Any company with an equity ratio value that is .50 or below is considered a leveraged company. Conversely, a company with an equity ratio value that is .50 or above is considered a conservative company because they access more funding from shareholder equity than they do from debt.

The shareholders equity ratio measures the proportion of a company’s total equity to its total assets on its balance sheet. When a company’s equity ratio is less than 50% (i.e. debt ratio is higher than equity ratio), it is known as a leveraged firm. Conservative companies are considered less risky compared to leveraged companies. Leveraged companies pay more interest on loans while conservative companies pay more dividends to stockholders. Businesses are contractually required to pay fixed interest regardless of operating outcome – whether they earn income or not.